2019 Stablecoin Review

Contributed by Dennis_Z

Table of Contents:

- 1. Why Stablecoins?

- 2. Types of Stablecoins

- 3. Stablecoin Review

- 4. Token Economics

- 5. Other Stablecoin Research

There are a lot of coins …… as of March 17, 2019, there are 2,112 tokens/coins tracked by CoinMarketCap, including utility tokens, security tokens, platform tokens …… Why stablecoins?

Stablecoins have gained steam recently in early 2019 especially after JP Morgan announced to create a JP stablecoin using private and permissioned blockchain to address a) the expensive and inefficient process of settlement and b) the volatility involved in holding money in cryptocurrency. This is considered a strong signal of enterprise adoption of blockchain technology.

1. Why Stablecoin?

Cryptocurrency has three major functions, similar to currency:

- Unit of Account

- Medium of Exchange

- Store of Value

However, unpredictable price fluctuation (e.g. BCH and many more) has been a huge concern for mass adoption of cryptocurrency as store of value due to the following reasons:

- Volatile market sentiment

- Less market liquidity

- Static monetary adjustment design

- Unregulated market

Here come Stablecoins, which aim to solve the price volatility concern by providing a stabilization mechanism for the coin value. The most well-known stablecoin is probably USDT (i.e., USD Tether), which was issued by Tether.io and pegged with USD dollar with 1:1 ratio. Back in 2017, if you were a beginner to invest in cryptocurrency, you will find that you need to either buy bitcoin or USDT in order to purchase other cryptocurrencies. Since then, there are a few other stablecoin projects. USDT is extensively used and promoted by Bitfinex. After September 4th, 2017 ban of crypto trading in China, USDT becomes the only viable gateway to crypto trading exchanges in China related crypto exchanges.

2. Types of Stablecoin?

Currently, 54 stablecoin projects are identified, including USDT, TUSD, GUSD, PAX, Maker/DAI, and Basis. Majority of new stablecoins were created in 2017 and 2018.

They are usually grouped based on the underlying collateral types.

- Fiat-collateralized: “Centralized” Stable Coins / Backed by Fiat Currencies, Collateral-backed

- Crypto-collateralized: “Decentralized” Stable Coins / Backed by Crypto Assets, Collateral-backed

- Non-collateralized: Seigniorage Shares / Decentralized Bank / Algorithmic Regulation Mechanisms

- Commodity-collateralized: Commodity-collateralized stablecoins are backed by other kinds of interchangeable assets, such as precious metals. Digix Gold (DGX), is an ERC-20 token (built on the Ethereum network) backed by physical gold, where 1 DGX represents 1 gram of gold. This gold is stored in a vault in Singapore and gets audited every 3 months to ensure transparency.

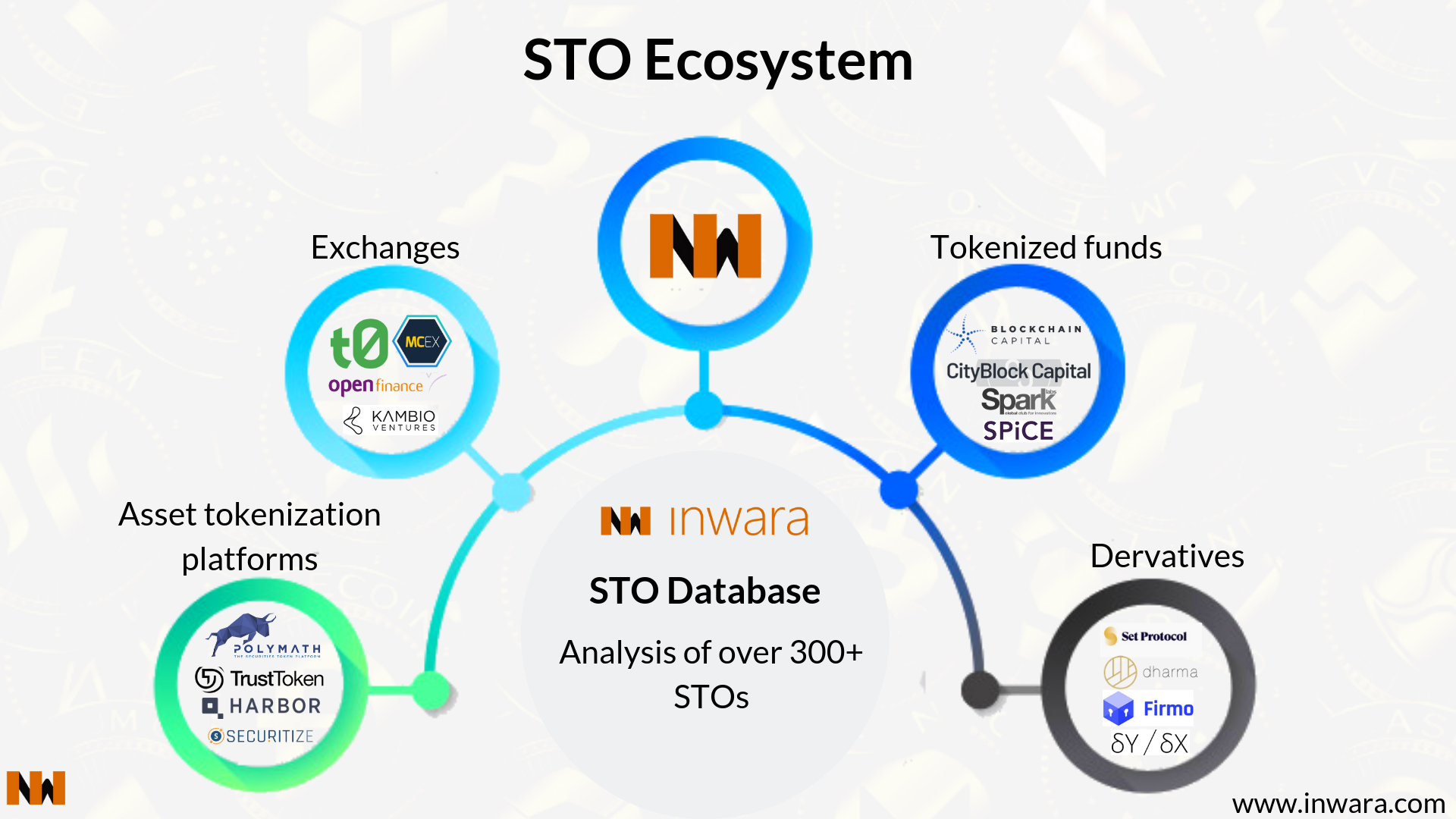

As shown above, stablecoins are not necessarily pegged to certain currency and can be pegged to one unit of asset, including cryptocurrency (e.g., BTC, ETH) or commodity (e.g. Gold). Therefore, STO (Security Token Offering)can also be treated as one kind of stablecoin conceptually as it is backed by one unit of financial asset/security. However, STO will not be discussed here but in a separate article.

3. Stablecoin Review

In this Section, major stablecoins will be reviewed by category. To assess each stablecoin’s popularity, we have considered to use the acceptance from Tier-1 crypto exchanges.

3.1 Fiat-Collateralized

3.1.1 USD Tether

USDT (USDTether) was the most well-know stablecoin. It was created by tether.io and promoted by Bitfinex and other crypto exchanges.

While USDT claimed that each USDT was backed by an equivalent amount of USD dollars, however there is NO continuous monitoring of the collateral pool. People constantly have concerns regarding Tether Solvency issue.

3.1.2 TUSD

TrueUSD is a price-stable cryptocurrency backed by US Dollars. Each 1 TUSD is redeemable for $1.00 USD. TrustToken is a platform to tokenize real-world currencies (such as USD and Yen) and assets (such as real estate, art, and IP).

3.1.3 Gemini Dollar

The Gemini Dollar stablecoin (GUSD) is one of the latest stablecoins, and was released on September 10, 2018. It is an ERC-20 token operating on the Ethereum blockchain and was created and released by the Gemini cryptocurrency exchange owned by the Winklevoss twins.

Based on the information in the tokens whitepaper, it will be “strictly pegged 1:1 to the U.S. dollar.”

Because it is pegged to the U.S. dollar, Gemini will use State Street bank to hold the USD assets, and has retained a pass-through insurance product to provide FDIC insurance within specific limits.

3.1.4 USDC

The USD Coin is an ERC-20 token and a member of the stable coin family.

USD Coin was created by Circle and Coinbase, and is the only stable coin traded on Coinbase. The USD Coin is part of the CENTRE stable coin framework, which requires full reserves, regulatory compliance, and regular audits.

USDC is mainly adopted by value chain of Circle, Coinbase and Poloniex (acquired by Circle in late 2018)

3.2 Crypto-Collateralized

3.2.1 bitUSD

The bitUSD is a market-pegged asset on the BitShares blockchain. It is often also referred to as a smartcoin, a bitasset, or just USD in the context of blockchain assets. It can be freely traded, or transferred on the BitShares blockchain and has a face value of 1 (one) U.S. Dollar.

bitUSD is an asset that is not backed by real dollar in someone’s bank account. Instead, the bitUSD is backed (e.g. secured) by the BitShares core token BTS. This means that behind any bitUSD, there are x amount of BTS that cannot be touched, traded or otherwise moved. These BTS are locked in a smart contract and serve as collateral.

3.2.2 Maker/DAI

Maker is the organization creating the stablecoin, DAI. DAI is pegged with USD dollar. DAI is created based on collateral with a collateral ratio. If the collateral asset is worth of $150, and the collateral ratio is 150%, the owner will receive 100 DAI when locking up the collateral through CDP.

Let’s say ether is worth $100 right now and the collateralization ratio is 150%. If I send 1 ether ($100) into the CDP smart contract, then I am now able to create 66 Dai. This means that, at the current value of ether, each 100 Dai that I’ve created is backed by 1.5 ether collateral. In the Maker system, you don’t lose your ether, but you also no longer control it. The ether that you sent to the CDP is stuck there until you pay back the 66 Dai (this destroys the Dai). The following diagram helps to visualize how you can open and close a CDP.

If the value of ether held as collateral is worth less than the amount of Dai it’s supposed to be backing, then Dai would not be worth one dollar and the system could collapse. Maker combats this by liquidating CDPs and auctioning off the ether inside before the value of the ether is less than the amount of Dai it is backing.

3.3 Commodity-Collateralized

Digix Gold (DGX) was created in 2014 and is a gold-backed token where 1 DGX represents 1 gram of 99.99% gold bullion that is stored in an independent and reputable vault and supplied by recognized precious metals dealers in Singapore. The gold ownership chain beginning from the bullion supplier, to the custodial holder and through to the independent audit process are fully public via the blockchain and IPFS document storage.

465,134 ETH was raised in March 2016 — the DigixDAO (DGD, tradable on Binance, Huobi Pro) was born. In April 2018, the company released its first asset token, DGX. The ETH raised were moved out of account on 9/4/2018 to liquid 70K of ETH, which was worth of $20 million.

3.4 Non-Collateralized

Basis aims to be a Price-Stable Cryptocurrency with an Algorithmic Central Bank. The differentiation is to replace the centralized stabilization mechanism by using a combination of tokens.

Basis is a Three-Token-in-One. To stabilize the coin value, when basecoin value drops below the pegged target, Base Bond will be kicked off to take proportional amount of basecoin out of the circulation to drive the value back to baseline.

- Base Coin — pegged 1-to-1 with the value of the U.S. dollar, it serves as the most user-facing of the three tokens, in that it’s the one exchange traders and other users would interact most directly with.

- Base Bond — Base bonds are tokens to be auctioned off programmatically by the blockchain when supply needs to be reduced, and these will expire within a time frame to encourage redemption.

- Base Share — provide a fixed-supply cryptocurrency that does not have a peg.

The Project was backed by many Tier-1 VC, including Bain Capital, Google Ventures, Lightspeed, Polychain and Andreessen Horowitz etc….

Other articles discussing the mechanism can be found at the following links

- https://medium.com/@dberry_11804/basecoin-an-overview-and-some-thoughts-ff8264b5b249

- https://medium.com/coinmonks/a-deep-look-at-the-basis-protocol-1c512f2356c5

Despite the ambitious vision, Basis has to shut down due to regulatory challenges in December 2018. It reaches to this difficult conclusion because there is no way to bypass the security status of base bond and base share. As unregistered securities, it can be only auctioned to a whitelist of investors [i.e., accredited investors] and this will limit their market liquidity and impact on coin value stabilization.

Therefore, given the current regulatory pre-maturity restrictions, algo-based mechanism has to be carefully designed to be in regulatory compliance.

4. Token Economics

For stablecoins, Token Economics is crucial to stabilize the underlying value. The design will need two layers of mechanisms to provide baseline benchmarking for the value and to drive the value back to baseline in case of fluctuation.

- Absolute Stabilization: The mechanism provides the baseline valuation for the coins, usually in forms of collateral pool.

- Relative Stabilization: The monetary mechanism to drive the coin value back to baseline in case of price fluctuation (e.g. Maker/DAI adjustment, similar to Marking to the Market)

In order to better understand the design of Token Economics in stablecoins, here are several models, which are likely to be used for Token Economics design.

- Mundell-Fleming Model — Impossible Trinity

- Fixed Exchange Rate System Design

- Closed-End Fund Design

5. Other Stablecoin Research

5.1 CB Insight Stablecoin Report “What are Stablecoins?”

CB Insights published its first Stablecoin Report in March 2019. It provides an overview of the current state of stablecoins, which can be downloaded @ThisLink.

In addition to review different types of stablecoins, the report summarizes the application scenarios of stablecoins, including

- Payment

- Remittance cross-border

- Protection from local currency crashes

5.2 2019 State of Stablecoins

Blockchain.com published a 2019 State of Stablecoins Report, which reviewed the current state of stablecoins from multiple dimensions. The major takeaways are summarized here. [Full Report]

- 54 identified stablecoins, 45% of which are live.

- 8 major stablecoin use cases

- 52% of stablecoins were crypto-collateralized

- Each stablecoin has its own targetd use case

- US and Europe are the most popular homes for stablecoin teams

- USD Tether (USDT) are still most widely used by Tier-1 Exchanges, while other stablecoins are catching up on the uses.

Appendix — Identified Stablecoin List

Disclaimer:

All of the information about projects are sourced from online materials and do not necessarily reflect the current state of the projects. The information here does not constitute any advice on investment or consequence of any investment.

Share, Follow & Clap 50 Times

No tip is necessary. If you like this article, please SHARE, FOLLOW & CLAP 50 times. Questions and comments are more than welcome. If you have a topic of interest, feel free to let me know.

Reference

- https://multicoin.capital/2018/01/17/an-overview-of-stablecoins/

- https://stablecoinindex.com/projects

- https://www.forbes.com/sites/rachelwolfson/2019/02/20/stablecoins-could-unleash-wall-street-adoption-of-blockchain-technology/#225ae1c0453c

- https://www.forbes.com/sites/yoavvilner/2019/01/11/stable-coin-101-what-where-why-and-plans-for-2019/#779a281e1fbf

- https://cointelegraph.com/news/makerdao-users-vote-to-raise-stablecoin-dais-stability-fee-by-2

- https://hackernoon.com/stablecoins-designing-a-price-stable-cryptocurrency-6bf24e2689e5

- https://cryptoslate.com/cryptos/stablecoin/

- https://en.wikipedia.org/wiki/List_of_cryptocurrencies

- https://coinmarketcap.com/all/views/all/

- https://www.coindesk.com/basis-stablecoin-confirms-shutdown-blaming-regulatory-constraints

- https://medium.com/@hasufly/tether-is-exiting-and-nobody-noticed-a7ce6dc30c56

- https://www.trustnodes.com/2018/09/04/ethereum-days-destroyed-spike-digix-moves-half-million-eth-%E2%97%8A54000-sent-gemini

- https://medium.com/cryptolinks/maker-for-dummies-a-plain-english-explanation-of-the-dai-stablecoin-e4481d79b90

- https://blog.trusttoken.com/trueusd-the-worlds-first-legally-backed-stable-cryptocurrency-is-now-trading-on-bittrex-6a49b621f058

- https://www.coinbureau.com/education/what-is-gemini-dollar/